Sovereign Wealth Fund 2025: An In-Depth Analysis

Sovereign Wealth Fund 2025: An In-Depth Analysis

Introduction to Sovereign Wealth Funds

A Sovereign Wealth Fund (SWF) is a state-owned investment fund used by governments to manage national wealth, often derived from surplus revenues, natural resource exports, or fiscal surpluses. SWFs play a crucial role in stabilizing economies, funding infrastructure, and ensuring long-term financial security for future generations.

The Global Landscape of Sovereign Wealth Funds in 2025

As of 2025, sovereign wealth funds collectively manage over $10 trillion in assets worldwide. Key players include:

- Norway’s Government Pension Fund Global (GPFG) – One of the largest SWFs, holding over $1.8 trillion in assets.

- China Investment Corporation (CIC) – A $1.5 trillion fund investing heavily in global infrastructure and technology.

- Saudi Arabia’s Public Investment Fund (PIF) – Expanding investments into tech, tourism, and renewable energy with $700 billion in assets.

- United States Sovereign Wealth Fund – Established in 2025, with plans to invest in critical infrastructure and medical research.

- Zambia’s Newly Launched SWF – Aiming to support national development through mining revenues and other state-owned enterprise dividends.

Recent Developments in Sovereign Wealth Funds (2025)

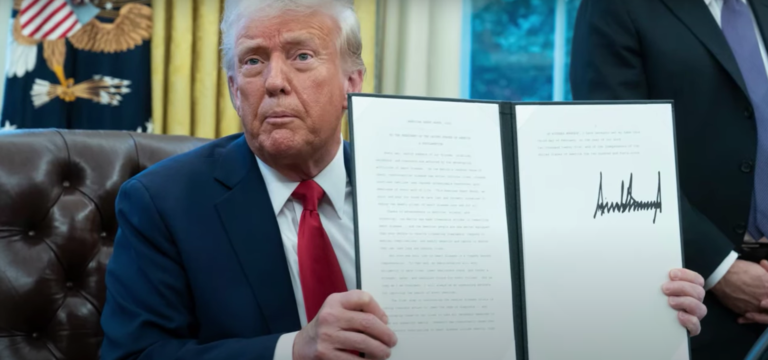

1. United States Sovereign Wealth Fund Initiative

For the first time, the U.S. has announced the establishment of a sovereign wealth fund. The initiative, signed into executive order by President Donald Trump in February 2025, aims to invest in:

- Infrastructure projects

- Medical research and innovation

- Federal asset monetization

- Potential acquisition of TikTok and other strategic assets (Read More on U.S. SWF)

2. Norway’s Increased SWF Spending

Norway has decided to increase its sovereign wealth fund spending to $43.1 billion in 2025, focusing on:

- Public services improvement

- Economic growth stimulus

- Energy transition projects (More on Norway’s SWF Strategy)

3. Saudi Arabia’s PIF Expansion

Saudi Arabia’s Public Investment Fund (PIF) has set a target to increase its annual investments from $40 billion to $70 billion post-2025. The fund is prioritizing:

- Technology and AI investments

- Tourism and entertainment sectors

- Renewable energy expansion (Saudi Arabia’s Investment Strategy)

4. Zambia’s First-Ever Sovereign Wealth Fund

Zambia has launched its first sovereign wealth fund in 2025, focusing on:

- Utilizing mining revenues, particularly from copper exports

- Investing in healthcare, education, and infrastructure (More on Zambia’s SWF)

The Role of SWFs in Economic Stability

Sovereign wealth funds are crucial in mitigating economic crises. In 2025, these funds are being utilized to:

- Stabilize economies in times of financial downturns

- Support national budgets without excessive borrowing

- Diversify revenue sources beyond natural resource exports

Challenges Facing Sovereign Wealth Funds in 2025

While SWFs provide financial stability, they also face challenges:

- Geopolitical Risks – Trade wars and sanctions affect investment choices.

- Market Volatility – Fluctuations in oil prices and global markets impact fund performance.

- Transparency Issues – Some SWFs lack sufficient public accountability.

- Ethical Concerns – Investments in controversial sectors raise concerns among stakeholders.

Future Outlook of Sovereign Wealth Funds

- Increased AI and Tech Investments – Countries are leveraging AI to optimize fund performance.

- Sustainable and Green Investments – Many SWFs are shifting towards renewable energy and ESG-focused initiatives.

- Greater International Collaboration – SWFs are forming strategic partnerships to enhance global investments.

Conclusion

Sovereign wealth funds continue to shape global economic landscapes, providing stability and financial security for nations. In 2025, emerging SWFs, like the U.S. and Zambia’s initiatives, mark a new era in strategic state investments.

External Links:

- Reuters: U.S. SWF Announcement

- Bloomberg: Saudi Arabia’s SWF Expansion

- Times of India: Norway’s SWF Spending

Would you like to add specific case studies or investor perspectives?