USA Stock Markets Today: Latest Trends and Insights

USA Stock Markets Today: Latest Trends and Insights

Introduction

The U.S. stock market plays a crucial role in the global financial system. Investors, businesses, and policymakers closely monitor its daily movements to assess economic conditions and make informed financial decisions. Today’s market activity is driven by several factors, including government policies, corporate earnings, and global economic events.

Stock Market Performance: February 4, 2025

As of today, the U.S. stock market has experienced notable volatility, primarily due to new tariff implementations by the Trump administration on imports from Mexico, Canada, and China. This policy shift has influenced investor sentiment, leading to a decline in stock futures and heightened market uncertainty.

Key Market Indices Performance

- Dow Jones Industrial Average (DJIA): Down 1.5% due to concerns over increased import tariffs and supply chain disruptions.

- S&P 500: Declined by 1.7%, with major losses in industrial and technology sectors.

- Nasdaq Composite: Dropped nearly 2% as investors pulled back from high-growth tech stocks.

- Russell 2000: Fell by 1.8%, reflecting weaker performance among small-cap stocks.

Major Factors Influencing the Market

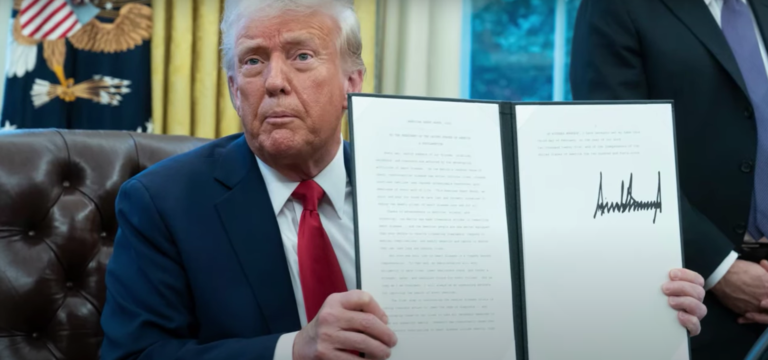

1. Tariffs on Imports from Mexico, Canada, and China

The recent tariffs have had a significant impact on market sentiment. The new policy includes:

- A 25% tariff on Mexican and Canadian imports.

- A 10% tariff on Chinese goods.

- Possible retaliatory measures from affected countries.

These tariffs are expected to increase costs for American companies relying on imported goods, especially in manufacturing and retail industries. Read more about the trade policy here.

2. Corporate Earnings Reports

Several major U.S. corporations have reported earnings this week, providing insights into their financial health and market outlook. Key companies in focus include:

- Apple (AAPL): Reported strong earnings, but its stock declined due to supply chain concerns linked to tariffs.

- Amazon (AMZN): Beat revenue expectations, but guidance for the next quarter was cautious due to macroeconomic uncertainties.

- Tesla (TSLA): Stock dropped as its production costs increased amid rising material prices.

For detailed earnings reports, visit CNBC Market Reports.

3. Hedge Funds’ Market Strategies

Hedge funds have been reducing their exposure to U.S. stocks for the fifth consecutive week. The primary reasons include:

- Concerns over economic slowdown due to tariffs.

- Increased short positions in industrial stocks.

- A shift toward real estate investments as a hedge against inflation.

More on hedge fund activity can be found in The New York Post.

Sector-Wise Performance

Technology Sector

- Microsoft (MSFT): Down 2.3% due to global tech sector weakness.

- Nvidia (NVDA): Fell by 2.8% as chip demand faces uncertainty.

- Meta (META): Slightly positive at +0.4% due to strong digital advertising growth.

Industrial Sector

- General Motors (GM): Down 7% as tariffs increase the cost of imported car parts.

- Ford (F): Declined 4% amid concerns over rising material costs.

Healthcare Sector

- Pfizer (PFE): Gained 1.5% as demand for pharmaceutical products remained stable.

- Johnson & Johnson (JNJ): Slightly up 0.7% as healthcare remains a defensive sector.

Investor Sentiment and Future Outlook

- Short-term volatility: Investors are cautious due to trade uncertainties and potential inflationary pressure.

- Federal Reserve Policy Impact: The Fed’s stance on interest rates will play a crucial role in market movements in the coming months.

- Long-term investment strategies: Analysts suggest diversifying portfolios to minimize risk exposure amid ongoing economic changes.

Conclusion

The U.S. stock market is facing significant headwinds today due to trade tensions, earnings reports, and macroeconomic uncertainties. Investors should stay informed, assess risk factors, and consider long-term strategies to navigate market fluctuations.

For real-time stock market updates, visit Yahoo Finance.

- External Links: